Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

The national "two sessions" are being held, and the employees in the cable industry can be said to be very encouraged from this "two sessions." First of all, due to the problem of smog pollution, the development of UHV and new energy has become a hot topic of this "two sessions"; and whether it is the development of UHV or new energy industry, it will benefit its supporting industry - wire and cable industry. Second, it is about the issue of 4G licenses. China Mobile Chairman Qi Guohua said in an interview with the media during the "two sessions" that China Mobile's 4G business is closer to commercial use, and the current test results are very satisfactory. Since the New Year in 2013, China Mobile has conducted commercial trials of domestic 4G standard TD-LTE technology in Hangzhou, Wenzhou, Guangzhou and Shenzhen. Chang Xiaobing, chairman of China Unicom, also said that “developing 4G technology is still early”, but during the “two sessions”, he expressed his hope for the government to issue 4G licenses as soon as possible, making the 4G policy clear and allowing operators to make corresponding decision. Obviously, China Unicom, which has not yet recovered from the large-scale investment of 3G, has already felt the offensive launched by China Mobile 4G. The issuance of 4G licenses will also directly drive the development of fiber optic cables.

With the issuance of 4G licenses and the popularity of 4G technology, the demand for fiber optic cables will be directly promoted. However, at present, the problem of the asset-liability ratio of the domestic fiber optic cable industry is still quite prominent, and the problem of overcapacity is also becoming increasingly prominent.

In 2012, fiber demand reached 125 million core kilometers, an increase of 17.1% compared to 107.1 million core kilometers in 2011. China's fiber optic cable demand accounts for 50% of global fiber optic cable demand. In the market expectation, due to the impact of the broadband China strategy, the market generally believes that it will greatly stimulate the rapid growth of demand in China's fiber optic cable industry, driving the rapid growth of the entire fiber optic cable industry, fiber optic cable industry companies have invested in additional project capacity, with a view to Cater to the expanded market demand.

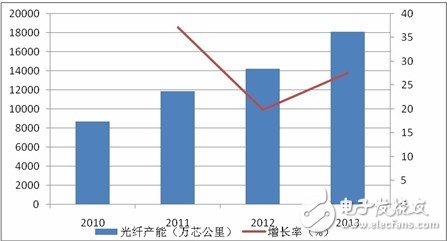

In 2010, the national fiber optic cable production capacity was 862 billion core kilometers, and by 2013, the domestic fiber production capacity exceeded 180 million core kilometers. In just four years, China's fiber optic cable production capacity more than doubled. Due to the industrial investment opportunities brought by the “Broadband China” strategy, most of the fiber optic cable companies are betting that “demands are rising by 50%-100%, and the industry is ushered in a burst of capacity expansion.

Figure 1 Domestic fiber production capacity

From 2010 to 2013, the capacity growth of local enterprises far exceeded the growth rate of capacity of foreign companies in their domestic production. Among them, Changfei, Zhongtian Technology's production capacity doubled; Hengtong Optoelectronics, Special Information, Xinmao Technology and other companies have more than doubled their production capacity; Bonfire and Fortis' production capacity have increased significantly. In addition to the expansion of production capacity, the other companies are foreign manufacturing companies in China: Corning, Samsung, Ternchi, Furukawa Fiber and Zhongzhu Fiber; the new fiber-option manufacturing company has Kaile Technology. This diversified industrial service provider based on high-tech new materials entered the fiber optic cable industry in 2013 and increased its production capacity by 10 million core kilometers.

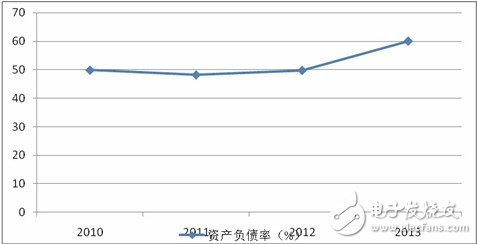

The large-scale construction of new projects of fiber optic cable enterprises must require investment of enterprises, and the investment of enterprise project funds will cause the increase of the company's own liabilities, which in turn will affect the increase of the industry's asset-liability ratio. In recent years, the asset-liability ratio of the fiber optic cable industry has increased significantly. In 2010, the industry's asset-liability ratio was 49.86%. By 2013, the industry's asset-liability ratio had reached 60.07%.

Due to the industry's own cycle of capacity building is not long, generally less than 2 years, the project's capital investment will affect its industry asset-liability ratio in the current period and in the next period; and many enterprises are continuous project investment, that is, the previous period The funds released from the input of production capacity will financially cover up the increase in liabilities caused by the funds invested in the current period.

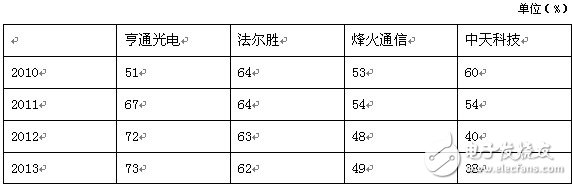

In the specific fiber optic cable industry, the asset-liability ratio of fiber optic cable companies shown in the following table, Hengtong Optoelectronics' asset-liability ratio rose steadily, from 51% in 2010 to 73% in 2013; Farr wins its asset-liability ratio It is very stable and remains at around 63%; the asset-liability ratio of FiberHome Communications and Zhongtian Technology is relatively reduced.

Figure 2 Fiber-optic cable industry asset-liability ratio

Figure 3 Fiber-optic cable enterprise asset-liability ratio

Note: The above data is the annual interim data.

Last year, China officially issued the “Broadband China Strategy”, but the actual demand of the market has not been substantially stimulated, and the positive “stimulus” brought about by its policies has been digested by the expected expectations of the previous period. The current status quo of the industry is that the substantive policy of the “Broadband China Strategy” has not exceeded expectations, that is, its demand for the market will not be greatly improved. At this stage, broadband cannot significantly increase the demand for optical fiber, and the construction of LTE will be given priority. Upgrading on the existing site is not as obvious as the previous 2G and 3G.

The introduction of the "Broadband China Strategy" has made the overcapacity that exceeded the demand of China's optical fiber market by 0.4 billion core kilometers into reality. The excess capacity will inevitably affect the sales and sales profits of industrial products and affect the operation of industrial enterprises.

In the industry, overcapacity is serious, fiber prices are falling, corporate profits are thinning, and the industry's asset-liability ratio of more than 60% should be alert to industry operators.

December 29, 2023

December 28, 2023

October 14, 2022

इस आपूर्तिकर्ता को ईमेल

December 29, 2023

December 28, 2023

October 14, 2022

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Fill in more information so that we can get in touch with you faster

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.